Englewood couple hires attorney during insurance dispute over Hurricane Ian damage

ENGLEWOOD, Fla. - Florida's home insurance crisis is escalating as more companies shed policies, and Hurricane Ian victims still can't get their homes repaired.

In Englewood, Chrissy and Stephen Spaziani had their home appraised 10 days before Hurricane Ian because they were planning to refinance. That fell through with their ceilings.

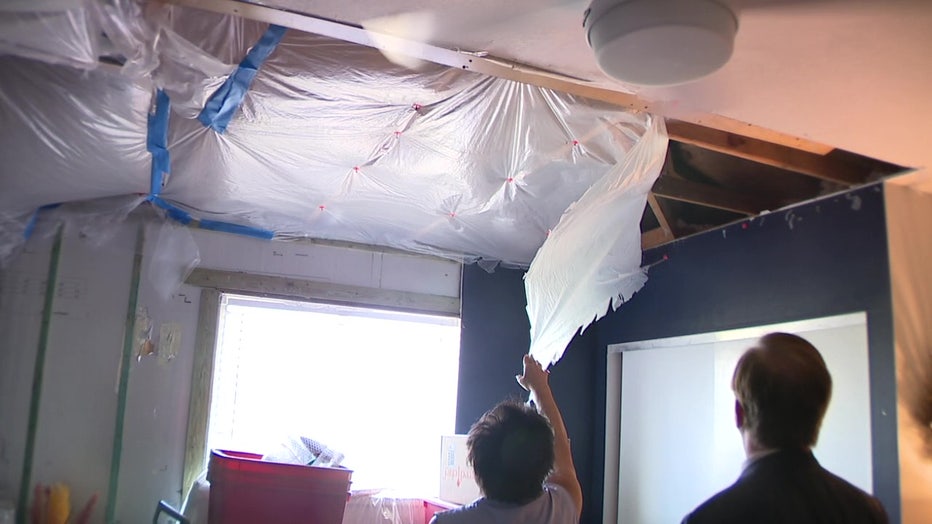

"At nighttime, if we’re sitting in here—this is where I’m afraid a critter is going to come flying in," said Chrissy as she pointed to large holes in a front room ceiling.

RELATED: Southwest Florida homeowners struggling to rebuild at Hurricane Ian as insurance premiums skyrocket

There were large holes in the ceiling after the hurricane went over the home.

With all the holes and gaps, they say flies buzz in at lunch and gnats swarm in at dusk. They’ve lived in a damaged house since Hurricane Ian struck last September.

"During the holidays this winter it was freezing. There was steam coming out of our mouths as we were eating Christmas dinner," Chrissy explained.

They moved to Florida six years ago. Hurricane Ian was their first major storm.

READ: Farmers Insurance pulls out of Florida, policyholders panic

"I was just scared. Like I can’t believe what’s going on right now," said Stephen.

When the hurricane passed, they discovered shingles blown off their roof, wet walls, and then large bubbles breaking out on their ceilings. Then they heard a swooshing sound and discovered their floors splattered in water, and soaked insulation.

An Englewood couples house is still not fully repaired after Hurricane Ian.

It ripped through a bedroom they used as an office and a separate bathroom.

They called a mitigation service who cleaned out the trashed rooms and showed them how their walls and ceilings were still holding water when they cut a square where there was no bubble.

"When they cut it out that water came rushing down," recalled Chrissy.

READ: Mobile home rent at Fort Meade park could double with new owner

They filed a home insurance claim after the storm and an adjuster showed up. Chrissy said a month passed with no follow-up.

When she called, she said the individual she spoke with accused her of fraudulently damaging their home. The Spazianis said they did not damage their home, but rather made their best efforts to bolster in advance of the storm.

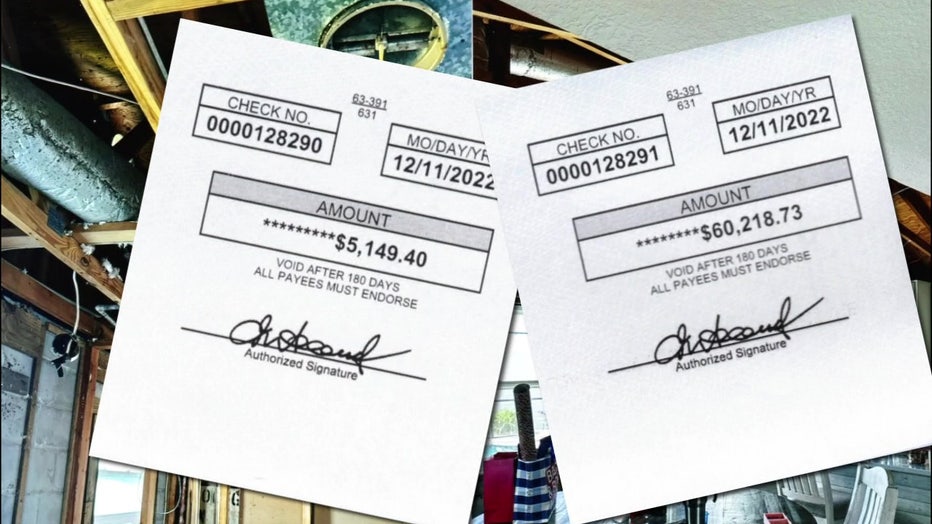

Chrissy and Stephen Spaziani haven't received the $200,000 that they need to repair their home.

They hired an attorney and are waiting for their dispute to resolve.

Insurance eventually paid around $65,000. But an independent adjuster put repair costs at around $200,000. The couple said the mortgage company is holding the money they have received in escrow until a contractor signs a repair contract. And they say no licensed contractor will agree to fix the damage at that price.

Saturday at 2:30 p.m., FOX 13 News will air a 30-minute special investigating Florida’s home insurance crisis. We’ll examine claims disputes, the reasons why home insurance premiums are soaring, and explain proposals to bring down our rates.