Floridians lost more than $311 million to investment schemes in 2023, according to new report

TAMPA, Fla. - Floridians are getting scammed out of money at an alarming rate and losing hundreds of millions of dollars last year, according to a recent investment fraud report.

The report, conducted by the investment fraud law firm, Carlson Law in Miami, found Floridians lost more than $311 million to investment schemes in 2023, the third highest total in the country. Only California and Texas had higher totals.

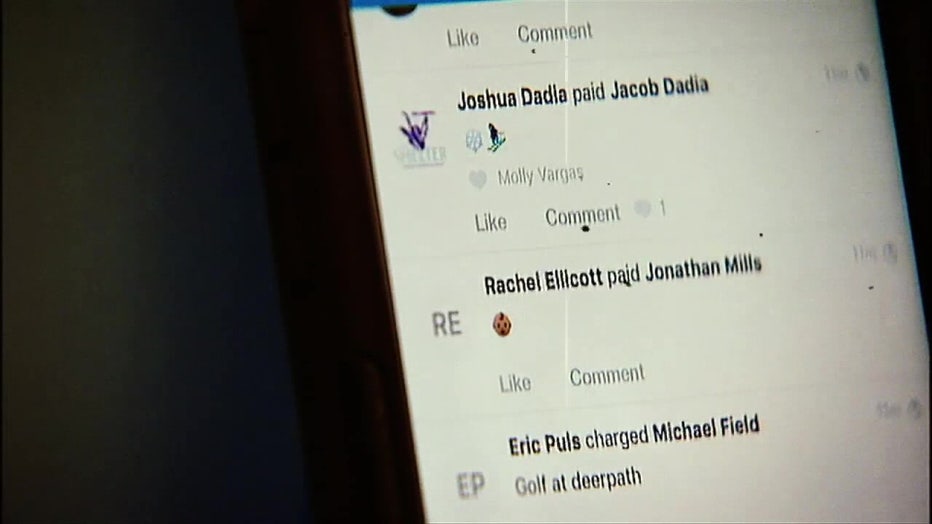

"It's a huge problem, especially here in Florida, which seems to attract a lot of people who are running scams and trying to take advantage of people," said Scott Silver, an investment fraud attorney in Coral Springs with the Silver Law Group. "Social media, the internet, the ability to basically promote these kinds of frauds and Ponzi schemes has made it much easier to target specific people and communities."

Experts said retirees are often the target of investment scams and can sometimes become victims of something called affinity fraud.

"One friend tells another friend who tells another friend everybody tends to think that somebody else is doing great due diligence, or they're hearing about the success they get fear of missing out," said Silver, explaining how affinity fraud works.

Meanwhile, the report indicated younger people are also losing money in investment fraud at an increasing rate.

READ: Waiting for mortgage rates to fall? Why experts say it won't make a difference

Ron Sanders, a cybersecurity consultant in Florida, said Gen-Zers and Millennials can sometimes fall victim to cryptocurrency scams.

"It's sort of a double whammy: seniors, on one hand, a lot of Gen-Zers and millennials on the other, and it makes for a perfect storm when it comes to scammers," Sanders said, adding the man schemers operate the same way. "It's somebody, somewhere sending out 100,000 or a million emails, hoping that they get one or two or three gullible people who will click and who will let them into their system."

Experts urge investors to do their due diligence before sending anyone their money.

"When you get something that looks suspicious, whether it's an email, a phishing attack, or even something that's more opinion than fact, and you're just not sure, then, follow it up," said Sanders.

"Make sure that you know who you're dealing with before you forward your money," added Silver, who said there are some questions investors should ask first. "Is somebody registered as a financial advisor? Who is the company that they're working for? Where is this company located? Are they properly registered? Are they stateside? Make sure that you know who you're dealing with before you forward your money."

To read Carlson Law in Miami's full report, click here.

STAY CONNECTED WITH FOX 13 TAMPA:

- Download the FOX Local app for your smart TV

- Download the FOX 13 News app for breaking news alerts, latest headlines

- Download the SkyTower Radar app

- Sign up for FOX 13’s daily newsletter