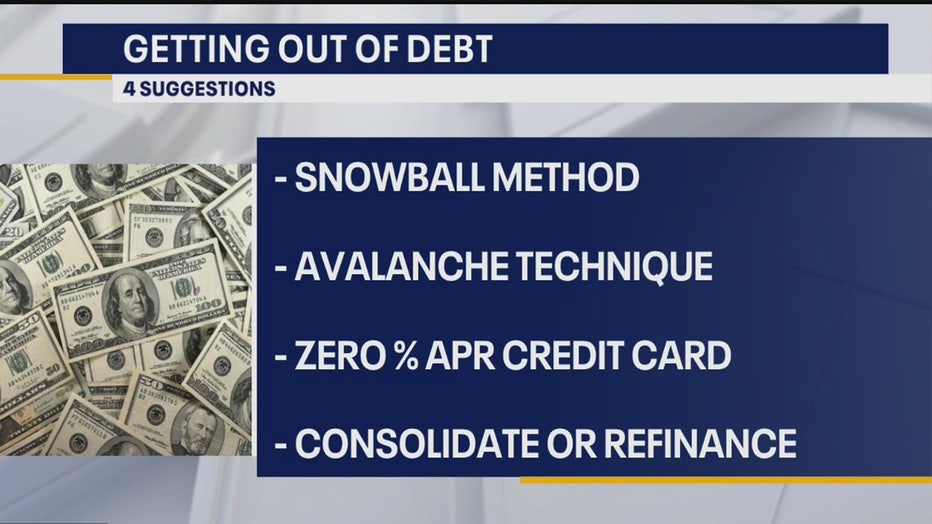

Four smart ways to get out of debt

Tips for getting out of debt

Jeff Rose, a certified financial planner, provides some constructive ways for paying off debt.

TAMPA, Fla. - Most of us, at some point in our lives, find ourselves in financial trouble. We look up one day and realize we're in debt.

According to a recent study by Experian, the average American has $97,427 in total debt. For many, getting into debt is easy, but getting out is where the challenges and frustrations become excruciating.

A couple of weeks ago, we talked about some of the mistakes that people make trying to get out of debt. Today, we're going to talk about some of the best strategies that can help you get out and stay out of debt for good.

Before we dive into these techniques, it's important to remember the two things that we all can control in regards to our finances is how much we spend and how much we make.

PREVIOUS: Your 2021 debt plan: The four biggest mistakes people make when trying to pay off debt

Keeping a diligent record of all of our spendings will help you get out of debt and also build wealth. This means a budget is a must if you truly want to get out of your debt trap. One of the budgeting techniques that I recommend is the 50-30-20 budget which allocates 50% to your needs 30% to your wants, and 20% to savings and paying off debt.

The other missing piece of the wealth-building puzzle is increasing how much you make. There's the obvious way of trying to increase your work income, but the pandemic hasn't been very helpful. Instead of seeing pay increases, we've seen more people getting laid off or furloughed. Many are just grateful to have any sort of income.

One of the best ways to increase your income outside of your job is adding a side hustle. There are many different types of side hustles that you can do in your spare time. I previously shared how delivery apps have exploded during the pandemic, such as DoorDash, Grubhub, and Uber Eats. Delivering for these services, or something similar like Instacart, is an easy way to add extra money to your bank account. On my blog, I list 12 of the most popular side hustles of the year, that you can test out.

Now that we have a primer, let's dive these debt payoff techniques.

1) Debt Snowball Method

This is actually one of my most favorite ways to pay off debt, even though many mathematic teachers may disagree. How the debt snowball method works is first, you have to list all of your debts, smallest to largest, regardless of the interest rate that you are paying on that debt.

Once you've identified what is the smallest debt that you owe, you focus all of your extra money into paying off that debt first, while making the minimum payments on the rest to avoid late payments or any penalties. Once you pay off the smallest debt, you move on to the next smallest debt, crossing each off the list as you go.

You might be wondering, why would you pay off a smaller debt that has, say, a smallest interest rate instead of tackling a larger one that may have, say, a 20% interest rate? The reasoning is simple: momentum. By paying off the smaller debt first, and most likely sooner, it gives you confidence and more excitement in tackling the rest of your debts.

The debt snowball method works because it's about behavior modification, not the numbers or basic math. It gives you hope, and for many, that is worth more than its weight in gold.

Common mistakes when paying off debt

Jeff Rose, a certified financial advisor, discusses some mistakes people commonly make when it comes to paying off your debt.

2) Debt Avalanche Technique

The debt avalanche technique is very similar to the debt snowball method. You will first need to identify all of your debts and list them in order, including their interest rates. The key difference with this method is instead of focusing on the smaller debt, you focus on the larger debt.

The rationale is simple in that, by focusing on the larger debt, you should save more money because you're paying off the debt with the highest interest rate compared to the smaller balance.

If you are one that is self-motivated and won't be detoured by how long it may take you to pay off this larger debt, then the debt avalanche approach works.

3) Transfer to 0% Credit Card

This may sound counter-intuitive since we are talking about paying off debt. Why this may be a smart approach for you depends on how much credit card debt you have and what is your interest rate or APR.

If you have a high interest rate, say somewhere between 15% to 25%, then transferring your balance from your high interest credit card to one that is paying 0% for, say, 12 months, then this could save you hundreds if not thousands of dollars. Please keep in mind that there may be a transfer fee.

Typically, you'll see 3% of your total balance. Plus, make sure to find out if the new credit card has any sort of annual fee, especially if your current one doesn't. You have to do the calculations to see if this strategy makes sense for your situation.

4) Consolidate or Refinancing Your Debts

If you have several different types of debts and it's becoming a bear trying to manage all of them, debt consolidation is a good debt payoff strategy to explore. One of the most common ways that people do this is taking out a personal loan and paying off all of their debts, and then making the payment to the new loan.

There are several personal loan providers nowadays that offer no fees, which include no origination fees, no prepayment fees, and no late fees. You can typically check online to see what your interest rate would be, and in turn your payment, to see if this method works.

Refinancing your debt can also make a lot of sense. This is very popular in the student loan space. College Avenue, an online lender in the student loan space, suggest that borrowers can save thousands on their student loans if they will take some time to do the research on refinancing their student loans.

Overall, taking any step to better yourself and get out of debt is a smart financial move. The key is to choose a method, any method, and just start.

Jeff Rose is a combat veteran, certified financial planner and founder of GoodFinancialCents.com