Haven’t filed taxes, but eligible for new child tax credit? United Way, IRS help families get monthly payouts

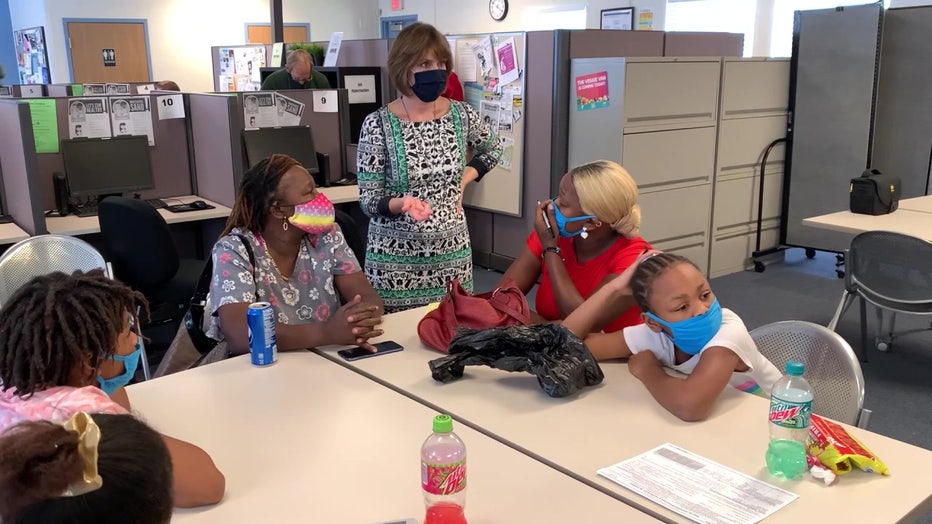

TAMPA, Fla. - The Suncoast United Way teamed up with the IRS office on Saturday to assist households that qualify for the child tax credit, but haven’t filed taxes.

"Our biggest challenge is people don't realize they're entitled to this credit," Internal Revenue Service Tampa Area Director Tracey Carter said.

The child tax credit is part of the $1.9 trillion coronavirus relief package. Usually, the child tax credit is paid in a lump sum, but this year, lawmakers chose to give half of the money to families monthly through the rest of the year to help parents with their monthly expenses. Households will get the other half when they file their 2021 tax returns next year.

"It can make a difference to families. There are some families that $300 a month extra will determine what they eat for dinner," Carter said.

On Saturday, the IRS officials helped at least 100 families that have not filed their taxes, but believe they're eligible for the child tax credit.

The credit is based on parents' modified adjusted gross income, the number of children and their ages. Qualified families are eligible to receive $300 per month for each child five years and younger, and $250 per month for children ages 6 to 17.

READ First child tax credit payment goes out July 15: What parents need to know

"We make sure that you are in the system and then that will trigger the system to know that you're entitled to that payment," Carter said.

For those who have paid taxes in the past couple of years, the money will be sent to you or deposited into your bank account.

Tampa was one of 15 cities in the nation to be chosen by the IRS to create the two-day program. More events like this one will be announced soon.

CONNECT WITH FOX 13:

Sign up for our daily newsletter