40-year mortgage benefits and drawbacks

TAMPA, Fla. - Struggling homeowners may find relief in a 40-year mortgage.

The Federal Housing Administration recently approved 480-month mortgages for homeowners finding it difficult to make their monthly payments.

It is designed to help those borrowers who cannot achieve a minimum targeted 25 percent reduction in the principal and interest portion of their mortgage payment through FHA’s existing 30-year mortgage modification with a partial claim.

It will give homeowners 10 more years to pay off their mortgages, with the goal of making mortgage payments more manageable.

READ: City leaders to turn 18-acre land in West Tampa into affordable housing near downtown

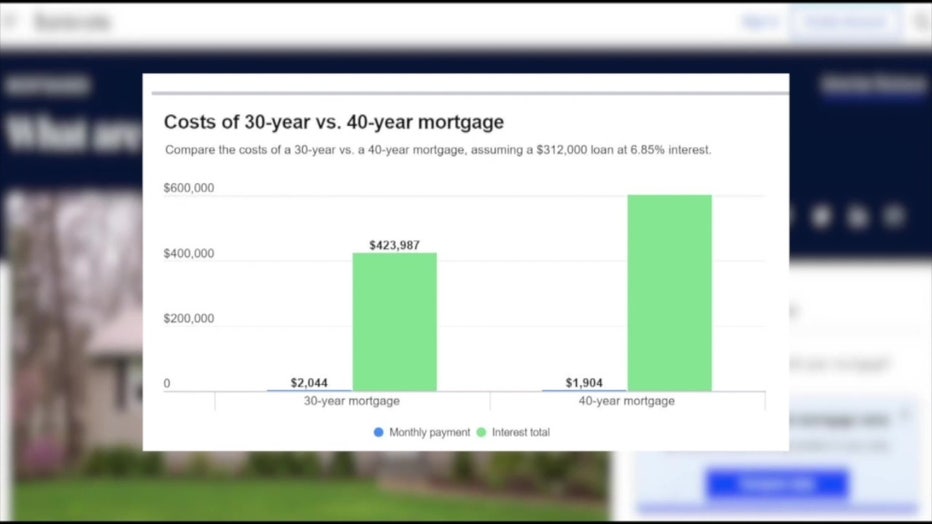

Homeowners would pay less each month because the payments would be spread out over a longer period. Experts say, though, it would also mean more interest in the long run.

Bankrate.com graph showing 40-year ,mortgage vs. 30-year mortgage.

Bankrate.com looked at the numbers and found on a $312,000 mortgage at 6.85 percent interest, the monthly payment for 40 years was about $100 less than the 30-year loan. Interest would be close to $170,000 more, though.

READ: Housing affordability is at the lowest level in over a decade

The Federal Housing Administration said the move will also help borrowers against default since they’ll be paying less per month.

The change goes into effect on May 8.