Want to lower your car insurance rates? Try these policy hacks

TAMPA, Fla. - Drivers across Florida are getting an unpleasant surprise about their car insurance. For many, premiums are going up by hundreds of dollars. Damage from Hurricanes Helene and Milton could drive rates up even more next year.

A Bankrate Study shows Florida already has the highest auto insurance in the nation--$1,402 more than the national average.

Ruth Allen couldn't believe how much her car insurance bill rose this year.

"We've had no auto accidents. We’ve had no car violations, no speeding violations, no infractions. Nothing," she said.

Allen and her husband's premiums still rose 35% this year or $800 more.

However, she discovered she was able to reduce her costs simply by switching the order of the names on the policy.

"Well, we were told if we put my husband’s name on the policy first, that they could save us $300 more," she said. "They’re insuring the same people, same automobiles."

While everyone on the policy is rated in terms of their driving record, policies are also rated based on other factors specific to the primary driver (or whoever is listed first).

Ruth Allen found that putting her husband's name first on their policy lowered their rates.

"The only thing I can think of is my husband is younger than I am," Allen noted.

Car insurance costs more when we're young, then rates go down for 30-plus years, then tend to nudge back up as we age.

"Age is probably the biggest difference," said Mark Friedlander. He speaks for the Insurance Information Institute, an association and research arm of the insurance industry.

He said there are also more than a dozen rating factors beyond the primary driver's age.

"Certain occupations are considered higher risk, for example, construction workers," he explained.

Different insurance companies offer discounts for different things such as grades or being a veteran.

Builders tend to pay more for auto insurance than office workers, and while it helped Allen to list her husband first-- it often works the other way around.

With all other factors being equal (or roughly equal), listing a wife before a husband can bring down the bill.

"If you have one male and one female on the policy, the female is probably going to be rated lower risk than the male on the same policy," said Friedlander. "Gender is a factor because actuarial analysis of the insurance industry show that female drivers tend to be safer and have less accident frequency than male drivers, and males have higher levels of DUI infractions than females."

READ: How Trump's win could impact the housing market

However, this can be outweighed by the primary driver's credit score. That can swing the price by more than a thousand dollars over a year.

"We looked at Florida and we found for consumers with perfect driving records and excellent credit, the average premium is $820. But if you have poor credit and an excellent driving record, you were paying an average of $2,000 for auto insurance--over twice as much, and that’s astonishing," said Michael DeLong, a researcher with the Consumer Federation of America.

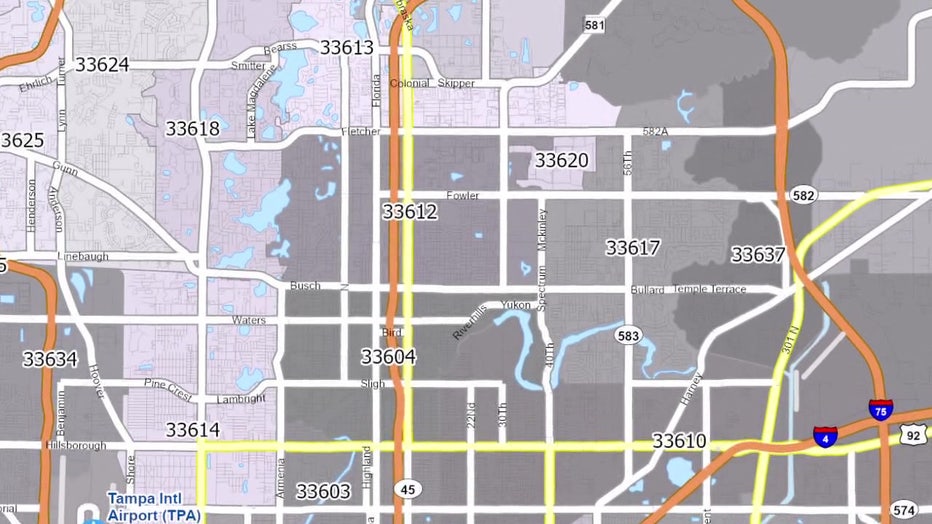

A person's zip code also factors into insurance rates.

Your home address can also make a difference.

"Insurance companies will charge more and sometimes a lot more based on the neighborhood or zip code they live in," Delong noted.

READ: Travel Tuesday 2024: Here's when it is and how to snag the best deals

Neighborhoods with a higher frequency of accidents have higher rates of insurance.

Each company puts a different weight on each variable, and they use different models to project a driver's risk of getting into a crash.

Industry analysts say that's why it's worth getting multiple quotes.

Insurance rates tend to drop as we age, but then climb back up.

"And you could get three quotes that could be several hundred dollars different between the three," Friedlander said.

Drivers can also let their insurance providers track their driving habits and pay less or more depending on the data from the trackers.

"Some companies may ding you for bad driving habits," Friedlander warned.

Many will charge more for insuring an electric car because they tend to cost more to repair, but that also varies a lot from one company to the other.

Insurers also offer different discounts which can include discounts for seniors, veterans, active military, honor roll students, and drivers who use electronic billing, paying the bills in full, and/or or taking a defensive driving course.

STAY CONNECTED WITH FOX 13 TAMPA:

- Download the FOX Local app for your smart TV

- Download the FOX 13 News app for breaking news alerts, latest headlines

- Download the SkyTower Radar app

- Sign up for FOX 13’s daily newsletter