How to protect yourself from COVID-19 scams

TAMPA, Fla. - We know that scammers will always try to get to you any way they can, and scams are a lot more common than many realize – especially online.

According to the Federal Trade Commission (FTC), in 2019, there were 3.2 million consumer-reported cases of scams generating over $1.9 billion in total fraud losses. That works out to about one in every 100 American citizens.

2020 has brought an uptick in financial scams due to the global pandemic. Scammers targeting unemployment benefit recipients, and those in desperate need of a stimulus check. With COVID-19 vaccines on the horizon, consumer watchdogs are expecting this to be the next big scam.

Who is most vulnerable?

First, let's address who is most likely to be targeted with a COVID-19 scam. Since frontline workers and the elderly are anticipated to get the vaccine first, it makes sense this is the group that scammers will target first.

This makes the elderly a big target for scammers who may try to make a quick buck by selling counterfeit versions of COVID vaccines.

This is no different than fake Nike sneakers or fake Gucci handbags. The difference here is that many have great fear about contracting the COVID-19 disease and will go out of their way to secure one for them and their family.

Signs of a potential COVID-19 scam

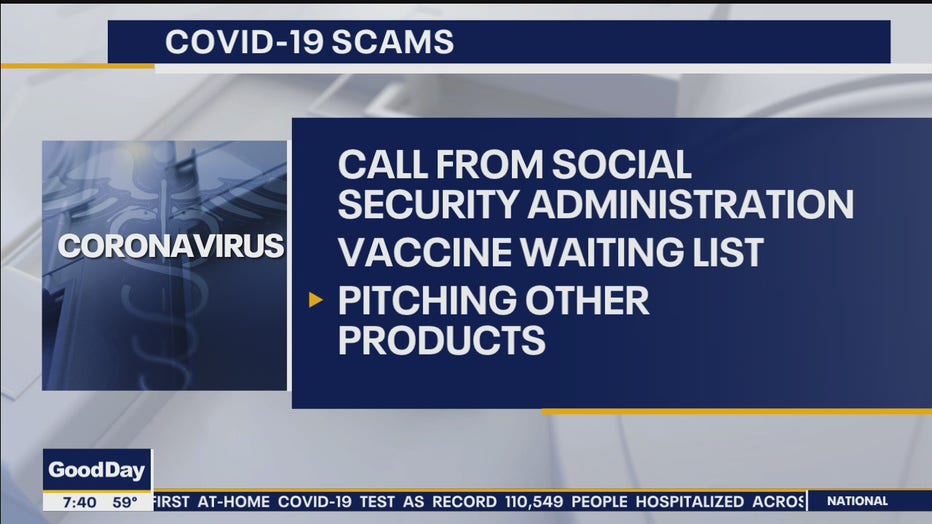

Similar to the stimulus checks and unemployment benefits, scammers will pretend they are from the Social Security Administration calling to say that they are signing up the person to get the vaccine.

First off, you will never receive a phone call from the SSA for this or anything that requires you to provide your sensitive information over the phone.

As part of the sign-up, the scammer is going to ask you for information such as your Medicare number, your name, address, and possibly your bank account information. Don't fall for it. This is a major red flag.

A potential scam is someone may call you to say that they can get you on the waiting list to get on a vaccine. It sounds intriguing. The only catch here is that they'll ask you to provide a gift card or maybe some sort of online cash payment to get on that list. Once again, another red flag. Do not offer or provide any data, as this could have Long-term ramifications to your financial health.

Another scam is to pitch products that make the bold, but untrue claim that it can either cure you of coronavirus or prevent you from contracting it. It's astounding what some people will do to take advantage of those that have great fear about the disease.

A Utah resident posed as a medical doctor, even going as far as uploading pictures of himself in a white lab coat with a stethoscope around his neck on the internet to pose as a medical doctor so that he could sell a silver-based product starting off at $300 with higher-priced offerings as well, all of which proved to be bogus. He eventually was indicted for his wrongdoings, but only after several had fallen victim to his scam.

Finally, in addition to phone calls, consumers will most likely be hit with phishing emails, texts, and even messages on social media platforms, such as Facebook. As a reminder, the Social Security Administration and the IRS will never contact you via social media.

If a link is ever included in those private messages or the email, never click it, as this may open the door to allow scammers to retrieve sensitive information from your home computer that could compromise your credit.

We all want to protect ourselves and stay healthy, but falling for one of these scams could end up having the opposite effect. Financial fraud can be devastating and the first line of defense is educating yourself and trusting your instinct.

Jeff Rose is a combat veteran, certified financial planner and founder of GoodFinancialCents.com