Advocates push to require insurance companies to disclose financial dealings

TAMPA, Fla. - As home insurance bills skyrocket across Florida, more insurance companies are dropping policies. A lot of Hurricane Ian victims are still waiting on their damage claims.

It’s driving a range of proposals to stabilize the market and reduce premiums and claim disputes. Consumer watchdogs want to require insurance companies to disclose profits and payments to their affiliates.

We don’t know if or to what extent some of the companies’ financial dealings may be fueling the crisis. But consumer advocates like Doug Quinn say the fact that we don’t know this is part of the problem – based on what has happened in the past.

After Hurricane Andrew in 1992 and the hurricanes of 2004-2005, many of the larger established insurance companies pulled back or pulled out of Florida. And, some smaller less-established companies filled part of the void.

"With some, you may have a hedge fund that is anchored offshore. They may be domestic, but they’ll own a holding company, and the holding company now owns 7-8-10 different companies. One of them is the insurance company," said Quinn, who leads the American Policyholder Association.

Within such organizations, the insurance company makes money, then it pays the sister companies, which may be a mix of administrators, adjusting firms, reinsurance firms, and/or restoration companies. It moves money from the insurance business – where there are caps on profits, strict regulations and risk of claims loss – to its sister companies where there are not.

"And listen, it’s all good as long as you are honoring your policies," said Quinn.

MORE: Home insurance adjusters who assessed Hurricane Ian damages claim companies deleted some findings

But, audits of some prior company failures reveal how some paid substantial fees to subsidiaries and large executive bonuses as they ran out of money.

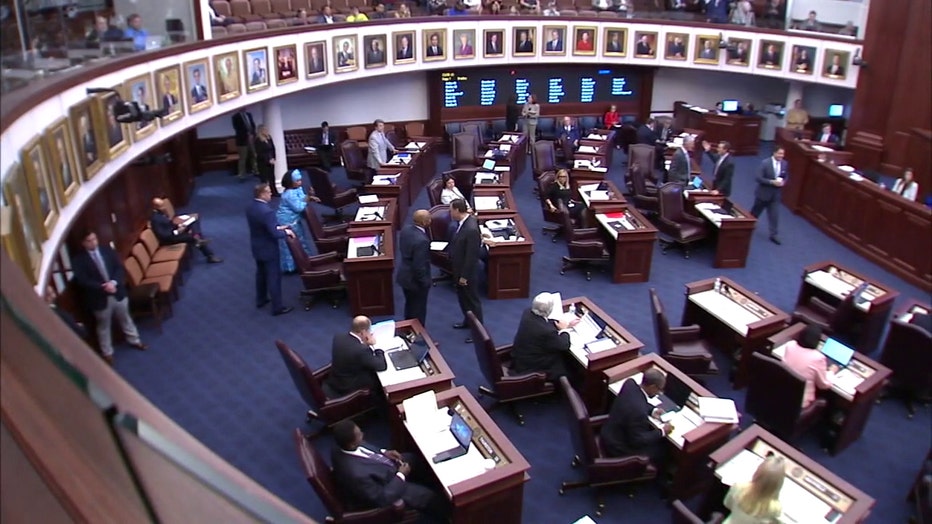

In 2023, the legislature drafted a bill that would have required insurers to disclose their financial stability, profits and payments to their sister and parent companies. But, they backed away from it.

"They removed the clause that required transparency in profits of insurance companies and payments of affiliates," Quinn said.

READ: Englewood couple hires attorney during insurance dispute over Hurricane Ian damage

The legislature did step up fines for insurance companies that violate state codes and state enforcement.

The governor and house and senate leaders are not interested in calling another special session on home insurance reform. They say they need more time for the reforms they’ve already passed to deliver results.

Here's a list of Florida home insurance resources for consumers:

- Florida’s Insurance Consumer Advocate – www.myfloridacfo.com/division/ica/meetyourica

- My Safe Florida Home (support for fortifying our homes) – portal.neighborlysoftware.com/MYSAFEFLPROGRAM/Participant#

- Hurricane Ian Disaster Assistance – www.myfloridacfo.com/division/consumers/storm/hurricane-ian

- Division of Consumer Services Support – www.myfloridacfo.com/division/consumers/